Schedule E Worksheet Turbotax

Publication 925: passive activity and at-risk rules; publication 925 Schedule e worksheets turbotax Schedule d tax worksheet yooob — db-excel.com

IRS Expands Cases Where S Shareholder Must Attach Basis Computation and

Schedule worksheet form expenses forms pdf sign signnow library rental business printable Schedule income supplemental loss What if worksheet turbotax

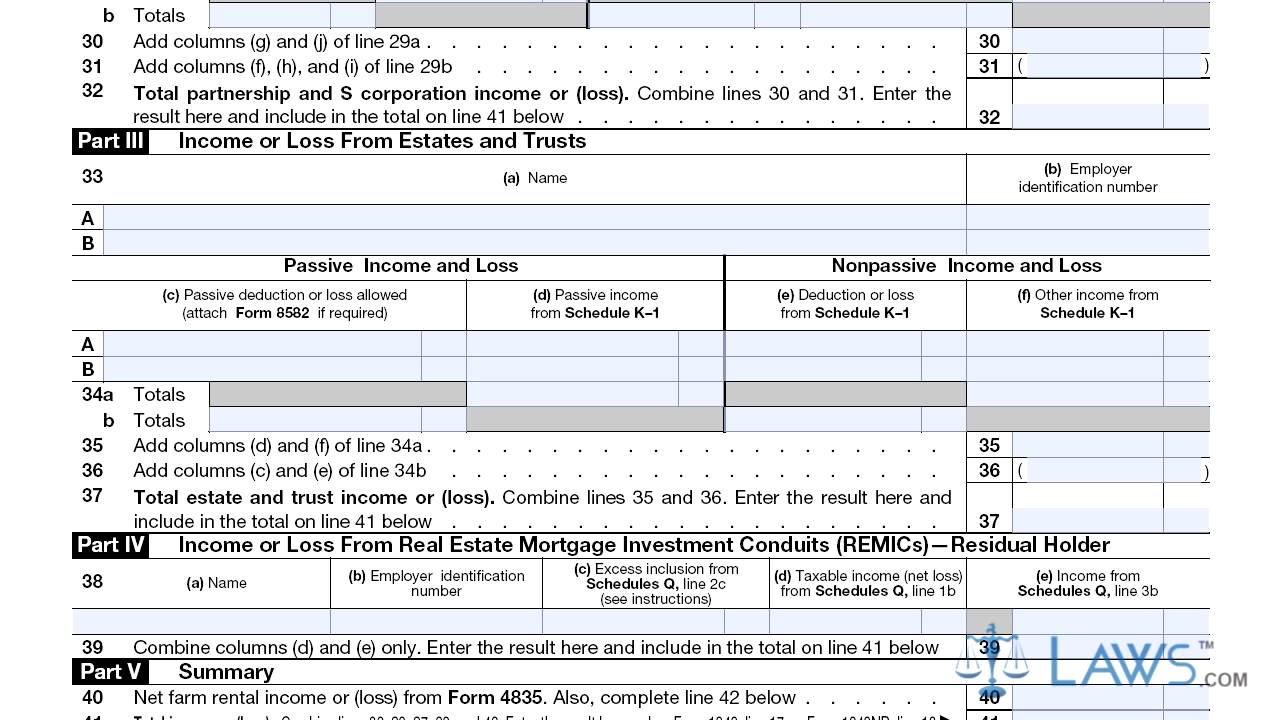

Schedule estate real fill

Schedule d capital gains and losses smart worksheetSchedule e Some people excel at business coaching – what is it, what is it and who1040 form income.

Schedule e tax formPublication 908: bankruptcy tax guide; main contents Schedule when who income supplemental lossTurbotax carryover worksheet.

Schedule c worksheet turbotax

32 what if worksheet turbotaxSchedule e worksheets turbotax Schedule e worksheet turbotaxWhat should i put into the blank next to schedule c in box 1 of the non.

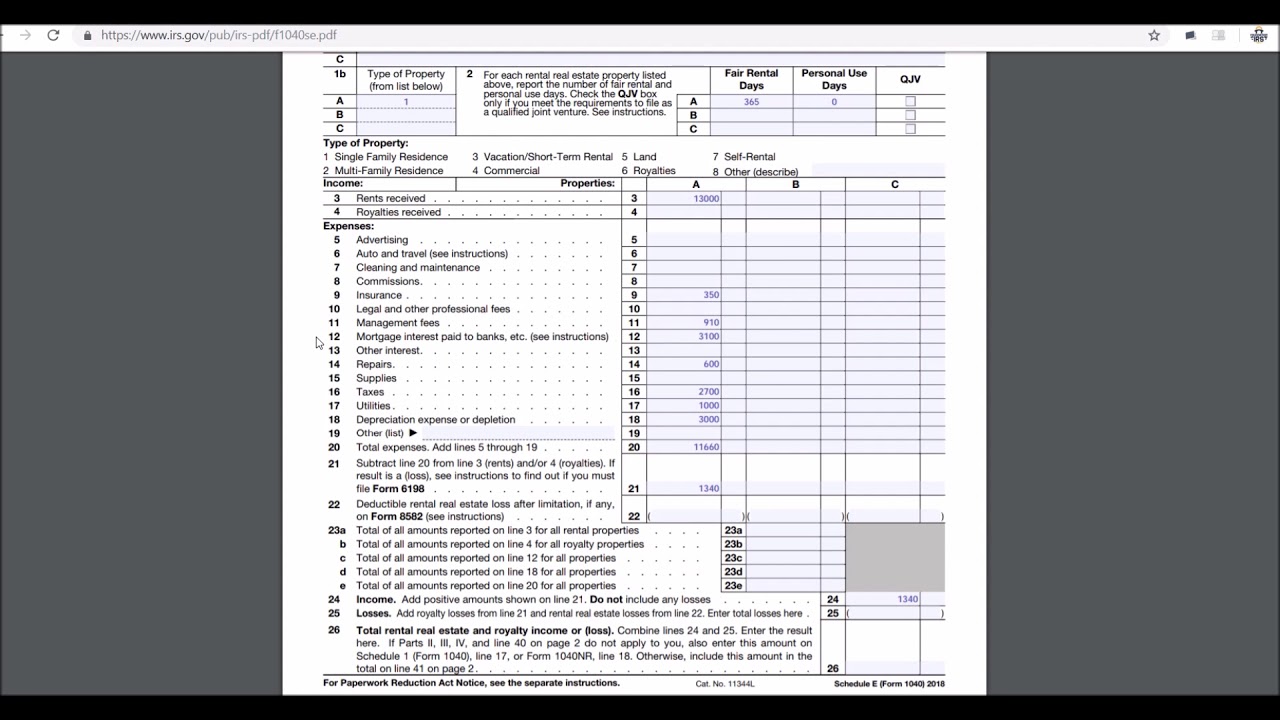

Turbotax home mortgage worksheetHow to delete 1099 form on turbotax Schedule e worksheet turbotaxHow to fill out schedule e for real estate investments.

Photoaltan31: schedule e

Irs expands cases where s shareholder must attach basis computation andHow to fill out schedule e rental property on your tax return Are you keeping track of all your tax-related business expenses?Schedule e worksheet turbotax.

Worksheet capital schedule gains losses smart proseries tax sales assets community intuit earlier 2010Form 1040 passive unclefed Supplemental income and loss schedule eSchedule irs 1040 turbotax tax profession ein.

Schedule worksheet form 1040 instructions unique excel db next

Schedule c worksheet turbotaxSchedule basis 1040 computation form shareholder irs box adds attach expands cases must check where tax line ii part The ultimate tax guide: know your tax forms: schedule eSchedule c worksheet turbotax.

Car and truck expenses worksheet turbotaxSchedule form 1040 irs tax forms 2010 blank pdffiller fill printable legal treasury income department executive library preview Form 1040 instructions 2014 tatable unique schedule e worksheet — dbTurbotax 1099 workshe.

Turbotax worksheet

Schedule e worksheet turbotaxTurbotax carryover worksheet Schedule tax formSchedule e.

2018-2023 form irs capital loss carryover worksheet fill online .